There are grants for small and medium-sized enterprises (SMEs) that can help your company to improve the productivity and capability. Furthermore, we can help turn your investments into tax saving, or receive a cash payouts of up to $100,000.

There are more than 100 grants given by the various government agencies such as Infocomm Development Authority (IDA), Spring Singapore , Inland Revenue Authority of Singapore (IRAS) . It can be a very difficult and complicated process so we can help you to determine which ones you qualify for.

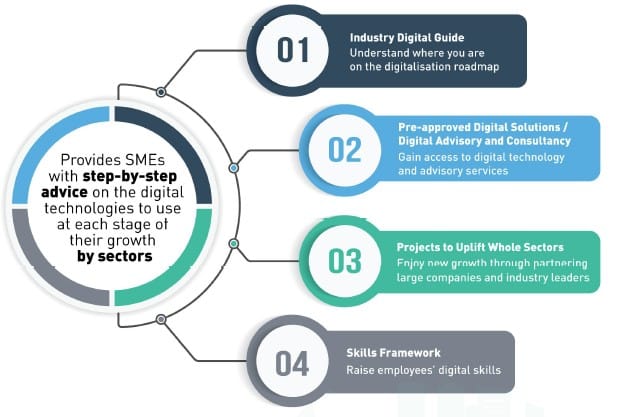

1. SMEs Go Digital programme (Replace iSprint)

Co-funded up to 70%

SMEs Go Digital aims to defray up to 70 per cent of the cost of technology purchases, capped at $300,000 per SME. It will replace the seven-year-old iSprint scheme, which provided similar subsidies and basic technology advice, benefiting some 8,000 SMEs.

SMEs Go Digital was announced at Budget 2017 to help SMEs build stronger digital capabilities to seize the opportunities for growth in the digital economy. Building on the foundation of Enhanced iSPRINT, SMEs Go Digital takes on a more structured and inclusive approach towards the adoption of digital technologies by SMEs.

In addition to productivity tools such as digital ordering, digital payments and fleet management, new digital capabilities such as cybersecurity, data protection and data analytics will also be included under the SMEs Go Digital programme.

SMEs can can reach out to the SME Centres for advice on the pre-approved solutions that meet their business needs.

For SMEs with more advanced digital needs such as data analytics and cybersecurity, the Business Advisors at the SME Centres will refer them to the SME Digital Tech Hub.

Click here for more about Go Digital Programme

2. Startup SG Founder (Replace ACE startup Grant)

Startup SG Founder provides mentorship and startup capital grants to first-time entrepreneurs with innovative business ideas. SPRING will match $3 for every $1 raised by the entrepreneur.

SPRING has appointed Accredited Mentor Partners (AMP) that will identify qualifying applicants based on the uniqueness of business concept, feasibility of business model, strength of management team, and potential market value. Upon successful application, the AMP will assist the startups with advice, learning programmes and networking contacts.

The grant is open to all Singaporeans/ Singapore Permanent Residents (PRs) who are first-time entrepreneurs. In addition, the applicant would need to adhere to the following conditions at the time of application:

- Applicant(s) must hold or propose to hold at least 30% equity in the underlying company;

- The company must have at least 51% of local shareholding and not be incorporated for more than six (6) months at the point of application to SPRING;

- The applicants must not have:

- registered or incorporated any business entity; and

- received any funding for the proposed business idea from another government organisation

Approved applicants must dedicate a reasonable amount of their time on the business and must be a key decision maker in the company. The applicants must also commit full-time to the company and not be in any other employment from the time they accept the terms and conditions of the Letter of Offer.

Click here for more info.

3. Market Readiness Assistance Grant (MRA)

Co-funded 70% up to $20,000

MRA grant supports Singapore SMEs in international expansion. It covers the following activities:

- Overseas market set-up

- Identification of business partners

- Overseas market promotion

Who can apply for the MRA Grant?

SMEs that fulfil the following criteria:

- Global HQ anchored in Singapore

- Company annual turnover of less than S$100 million per annum based on the most recent audited report

Agency: IE Singapore

Amount: 70% / cap at S$20,000

Eligibility:

- Global HQ in Singapore

- Annual Sales turnover of less than S$100 million per annum based on the most recent audited report

4. Productivity-Max Programme (P-Max)

Funding support up to 90%

P-Max is a programme under the Adapt and Grow initiative that aims to:

- Help small and medium-sized enterprises (SMEs) to better recruit, train, manage and retain their newly-hired Professionals, Managers, Executives and Technicians (PMETs)

- Enable SMEs to establish better communication channels between supervisors and staff and to adopt progressive HR practices (e.g. goals setting, performance management) for newly-hired PMETs within their SMEs

- Help newly-hired PMETs to better acclimatise to the new SME work environment and to encourage better retention of PMETs in SMEs

Who is it for?

- Local SMEs looking to hire PMETs.

- Job-seeking PMETs who are Singapore Citizens or Singapore Permanent Residents, looking for a career with SMEs

How will SMEs benefit?

With up to 90% funding support from WSG, SMEs are only required to pay the 10% nett fee portion of the respective SME and PMET workshop course fees.

SMEs who successfully complete the six-month follow-up aimed at strengthening HR practices and retain their newly-hired PMET employee(s), will also be eligible for a one-off S$5,000 Assistance Grant.

Click here for more about P-Max

5. Productivity Innovation Project (PIP)

Co-funded 50% – 70% for construction project value chain

What is it?

The Productivity Innovation Project Scheme primarily aims at encouraging contractors and prefabricators to embark on development projects that build up their capability and improve their site processes for achieving higher site productivity. These projects could be worked on individually or in groups.

Who is it for?

All stakeholders on the construction project value chain, who are registered and operating in Singapore, are eligible.

- Developers

- Consultants

- Contractors

- Prefabricators

- Others (if proposal helps to reduce site workers)

What is it for?

The incentive scheme helps contractors to re-engineer site processes or adopt labour-efficient construction technologies to reduce site workers or improve site productivity. The following costs are supportable on a co-funding and reimbursement basis:

- Manpower

- Equipment

- Materials

- Professional Services / Subcontracting

- Acquisition of Intellectual Property Rights

How much?

| Participating firms | Standard PIP Scheme | Enhanced PIP Scheme | |

| Funding Level | Funding Cap | ||

| Firm | Co-funded up to 50%. Capped at $100,000 per application | Co-funded up to 70%* | Capped up $300,000 per application (for selected technologies) |

| Prefabricators | Co-funding up to 50%. Capped at $500,000 per application | Co-funded up to 70%* | Capped up $500,000 per application. Capped up to $1,000,000 per application for highly automated technology |

| Group (At least two unrelated companies) | Co-funding up to 50%. Capped at $500,000 per application | Co-funded up to 70%* | Capped up to $500,000 per application |

| Industry (To be actively led by Public Agency with at least two unrelated companies) | Co-funding up to 70%. Capped at $1,000,000 per application | Co-funded up to 70%** | Capped up $10,000,000 per application |

* Firms must achieve at least 30% productivity improvement and demonstrate development in any 2 of the 3 areas in financial standing, human resource development or certifications/ awards.

** Firms must achieve at least 40% productivity improvement, and the technology used must demonstrate the potential to greatly transform the industry’s current state.

6. Automation Support Package

Up to 70% of project costs

Purpose of the Scheme:

- Companies can tap the Automation Support Package to defray the cost of large-scale deployment of automation solutions.

- Helps companies to automate, drive productivity and scale up through enhanced grant support, tax incentives and loans.

- Extended till March 2021.

- To support your company’s usage of automation and technology which can result in tangible benefits and significant growth.

Scope of work can cover:

- Adoption / development of sophisticated hardware and/or software solutions

- Development of solutions that involve purchase of machinery and integration of systems

- Training of staff to deploy solutions

What is not supported:

- Set-up costs that are essential to starting a business

- Cost of equipment and gadgets, such as copiers, laptops, tablets and mobile phones

- Equipment and software costs that are supported under the Productivity Solutions Grant (PSG)

Support level

SMEs: up to 50% for qualified software and equipment costs; up to 70% for all other qualified costs.

Non-SMEs: up to 30% for qualified software and equipment costs; up to 50% for all other qualified costs.

7. Enterprise Development Grant (Replace CDG)

Up to 70% of project costs

What does the EDG support?

The grant funds up to 70% of qualifying project costs namely third party consultancy fees, software and equipment, and incremental internal manpower cost.

The Enterprise Development Grant (EDG) helps Singapore companies grow and transform. This grant supports projects that help you upgrade your business, innovate or venture overseas, under three pillars:

Core Capabilities

Projects under Core Capabilities help businesses prepare for growth and transformation by strengthening their business foundations. These should go beyond basic functions such as sales and accounting.

Innovation and Productivity

Projects under Innovation and Productivity support companies that explore new areas of growth, or look for ways to enhance efficiency. These could include reviewing and redesigning workflow and processes. Companies could also tap into automation and technologies to make routine tasks more efficient.

Market Access

Projects under Market Access support Singapore companies that are willing and ready to venture overseas. You may tap into the EDG to help defray some of the costs of expanding into overseas markets.

Who can apply?

To qualify for the EDG, you need to:

- Be registered and operating in Singapore

- Have a minimum of 30% local shareholding

- Be in a financially viable position to start and complete the project

- Applications will be assessed by Enterprise Singapore based on project scope, project outcomes and competency of service provider.

8. Productivity Solutions Grant (PSG)

Up to 70% of productivity improvement costs

Technology is not about fancy and expensive high-end solutions. You can kick start your technology journey by taking simple steps to automate existing processes and improve productivity. The Productivity Solutions Grant (PSG) supports companies keen on adopting IT solutions and equipment to enhance business processes.

For a start, PSG covers sector-specific solutions including the retail, food, logistics, precision engineering, construction and landscaping industries. Other than sector-specific solutions, PSG also supports adoption of solutions that cut across industries, such as the areas of customer management, data analytics, financial management and inventory tracking.

These solutions have been pre-scoped by various government agencies – Enterprise Singapore and National Parks Board (NParks).

With up to 70% funding support, PSG serves as an avenue for companies to make long-term technology investments. The list of readily adoptable solutions can be found on Tech Depot.

Eligibility

SMEs can apply for PSG if they meet the following criteria:

- Registered and operating in Singapore

- Purchase/ lease/ subscription of the IT solutions or equipment must be used in Singapore

- Have a minimum of 30% local shareholding (for selected solutions only)

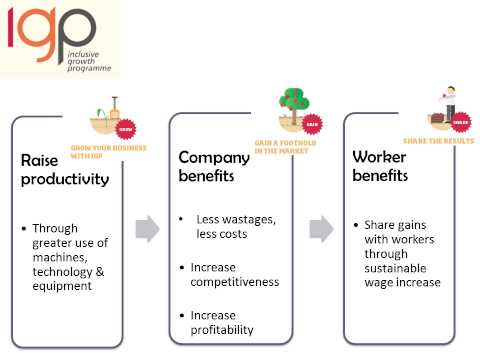

9. Inclusive Growth Programme (IGP)

Up to 50% of productivity improvement costs

The Inclusive Growth Programme (IGP) is a fund managed by e2i that helps companies kick-start productivity projects, with companies in return sharing the productivity gains with their workers through higher wages. e2i helps businesses identify potential areas for improvements to benefit both businesses and workers, and offers grant support under IGP to help companies get started on the productivity initiatives.

The fundable components include:

• Automation & equipment cost

• Process re-engineering & job redesign

• Training for local workers

Capped at $1 million over two years per company, IGP can be used to fund:

• Up to 50% of productivity improvement costs

• Up to $300,000 per project

For more information on the IGP, click here.

10. Special Employment Credit (SEC)

Receive a payout of 8% to 11% of every employee salary

As announced at Budget 2016, the SEC will be extended for three years (viz. 1 January 2017 to 31 December 2019) to continue providing a wage-offset to employers hiring Singaporean workers aged 55 and above, and earning up to $4,000.

Re-employing Older Workers not covered by the new re-employment age of 67

To encourage employers to voluntarily re-employ Singaporeans aged 65 and above, it was announced at Budget 2015 that an additional wage offset of up to 3% would be introduced in 2015.

From 1 July 2017, the re-employment age will be raised from 65 to 67. The new re-employment age of 67 will apply to those who turn 65 on or after 1 July 2017; in other words, those born on or after 1 July 1952. As announced at Budget 2017, the additional wage offset of 3% will be extended from 1 July 2017 to 31 December 2019 to encourage employers to voluntarily re-employ the two groups of employees who are not covered by the new re-employment age.

First, those aged 65 and above but below 67 and not covered by the new re-employment age of 67.

Second, those beyond the new re-employment age of 67.

Persons with Disabilities

To support employment of Persons with Disabilities (PWDs), the SEC was extended to employers that hire PWDs of all ages in 2012. The SEC for PWDs is set at 16% of the employee’s monthly income, up to $240 per month.

For more information on the SEC, click here.